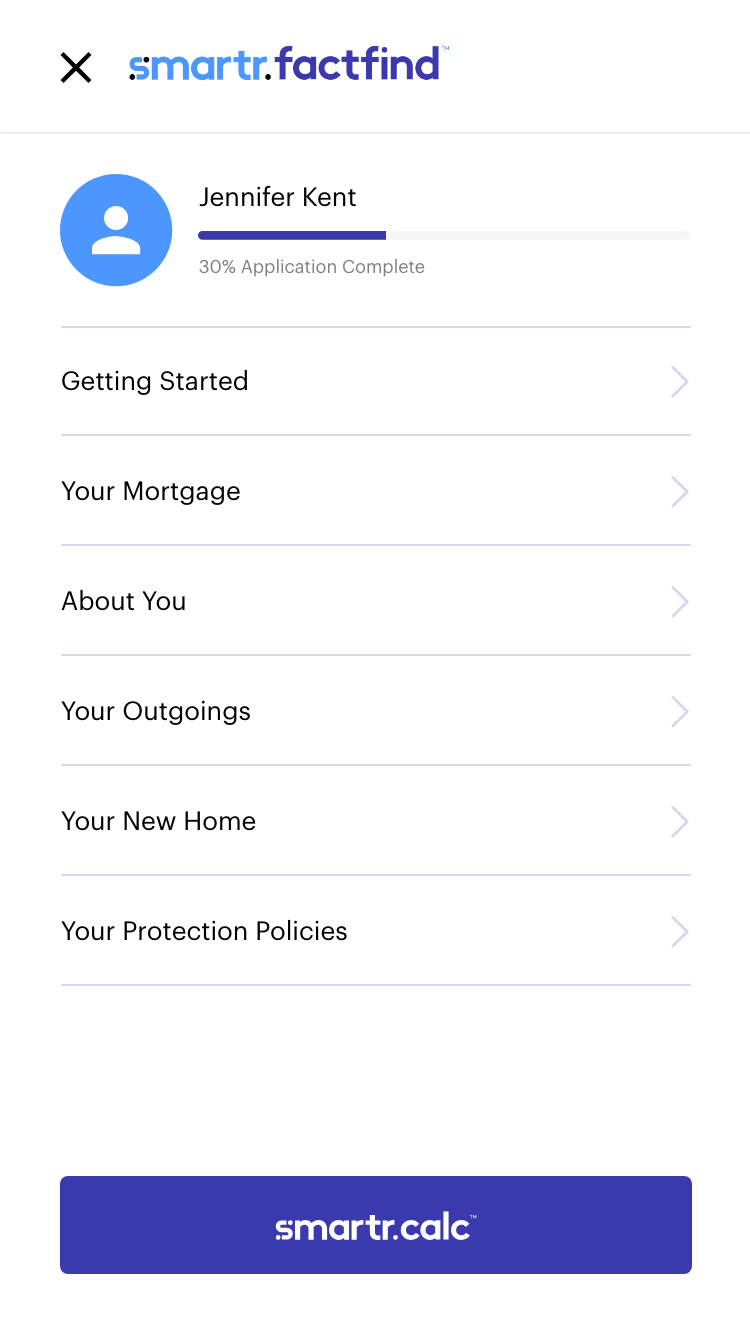

Smartr365 started life as an internal CRM system within a mortgage brokerage. They spotted a market opportunity to create a product that would streamline the mortgage industry.

In just 4 months we re-designed and re-skined their customer-facing systems to prepare Smartr365 for a fund raising pitch to an industry leader; Legal & General. Needless to say, they secured the investment, and we are still working with Smartr365 to innovate their platform.

- Lead time:

- Phase 1: 4 Months

- Phase 2: 12 Months

- Sector:

- Fintech

- Target Type:

- B2B & B2C

- Demographic:

- Finance Professionals

- Project Goal:

- Industry Leading Mortgage Processing

- Services:

- UX Design, UI Design, Angular7 Development

The Smartr365 interface cuts adviser workload down

from more than 10 hours to just a few minutes

The Smartr365 product had been developed over many years to deliver upon functional requirements. However as the system grew it became more cumbersome to use, and increasingly difficult to on-board new people. As such, they needed a serious User Interface and UX design overhaul.

- Scope

- Solution Design

- Adobe XD Wireframes

- Adobe XD Prototypes

- Angular7 Front-end Development

- QA and Testing

- Resource

- 1x Senior UX Designer

- 1x UI Designer

- 2x Senior Angular7 Developers

- 1x Senior Front-end Developer

- 2x Quality Assurance Testers

- 1x Technical Project Manager

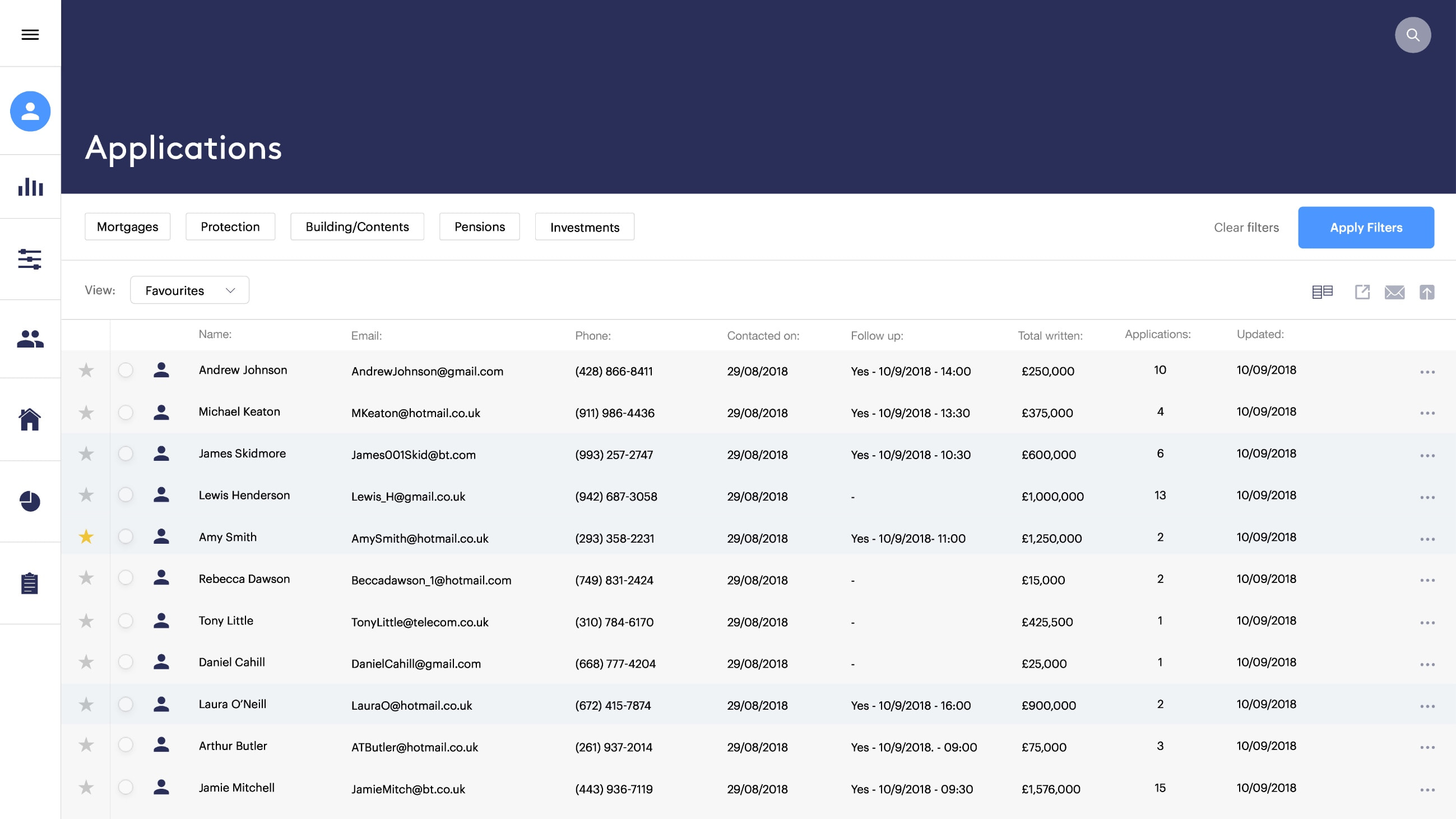

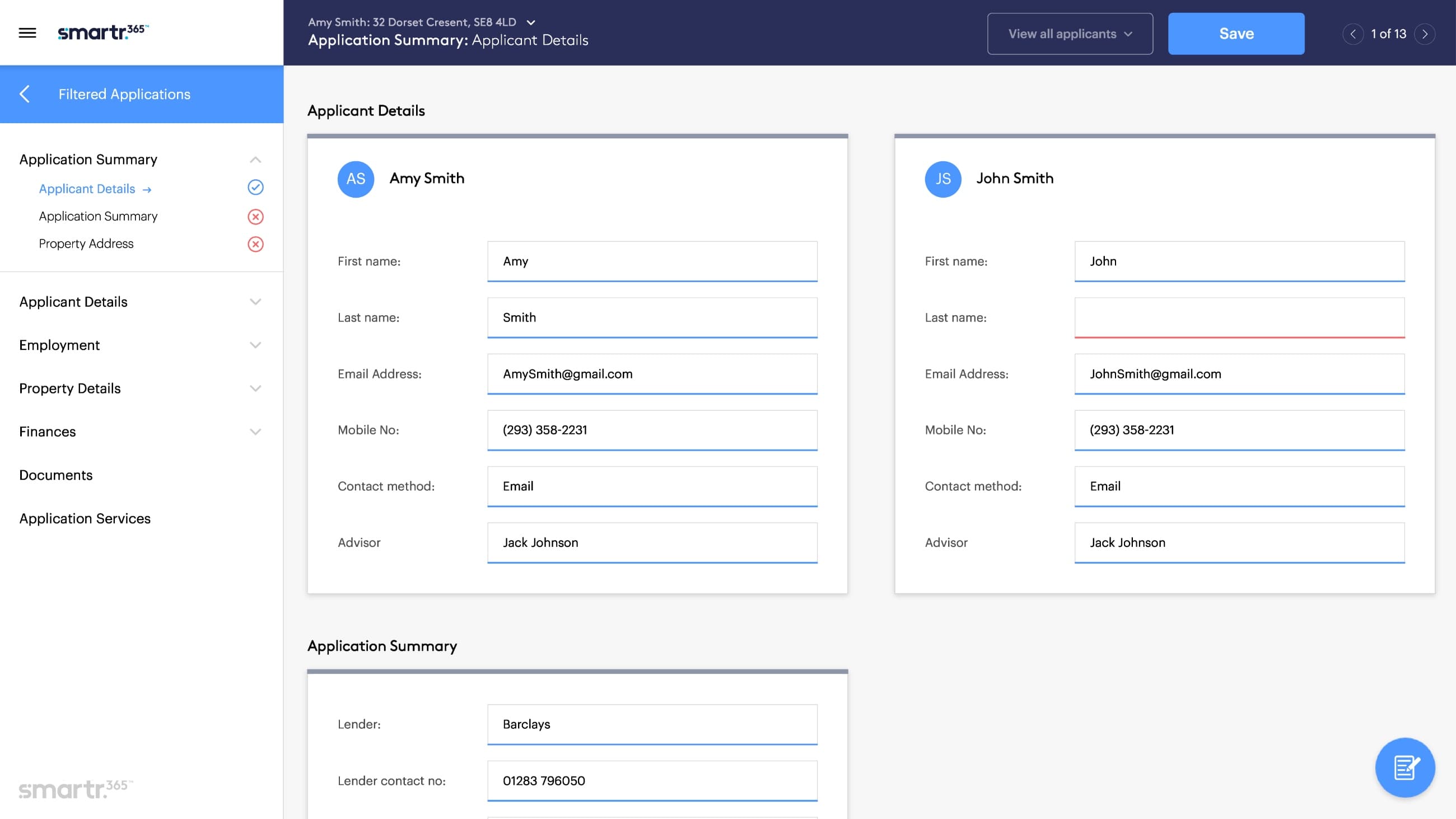

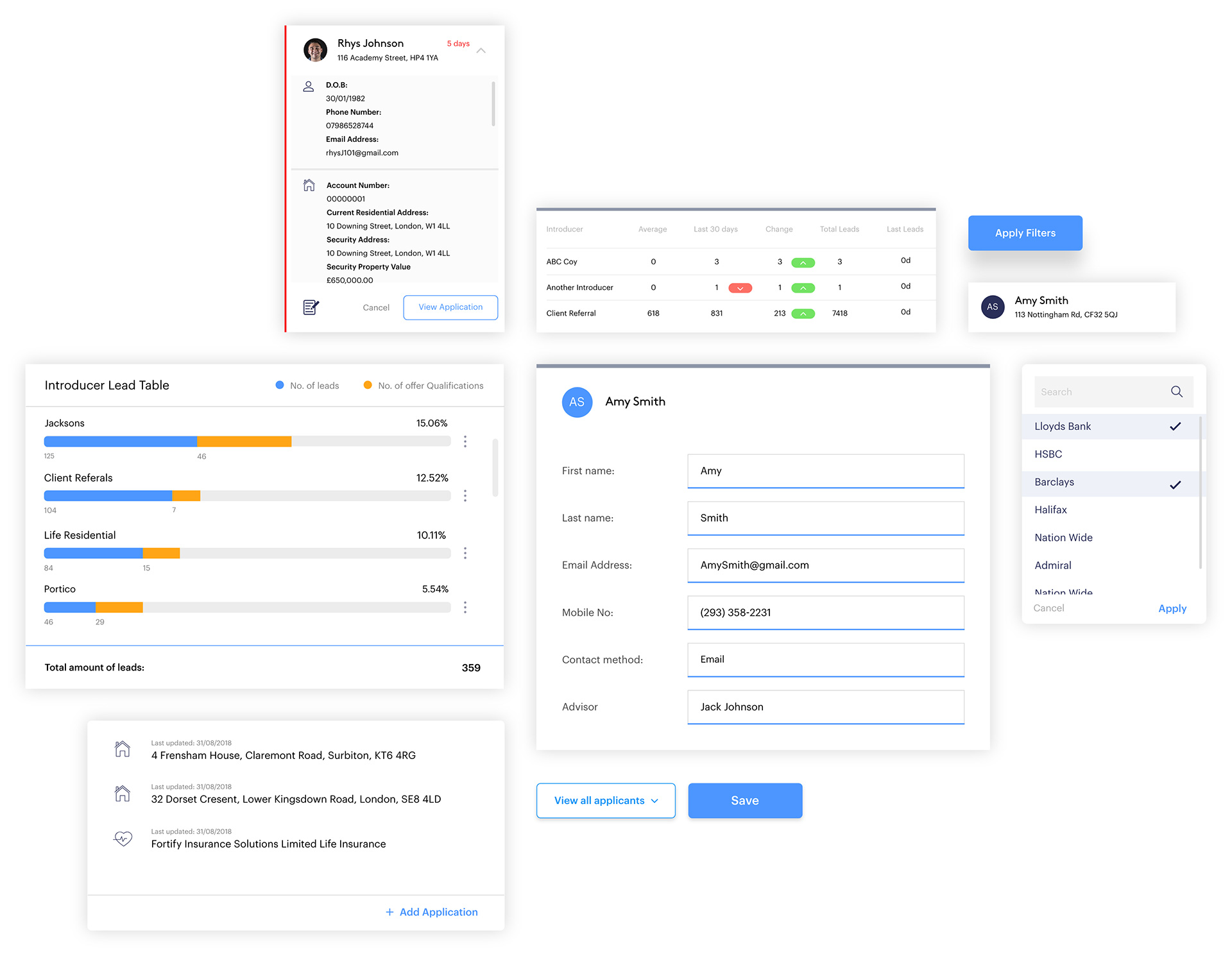

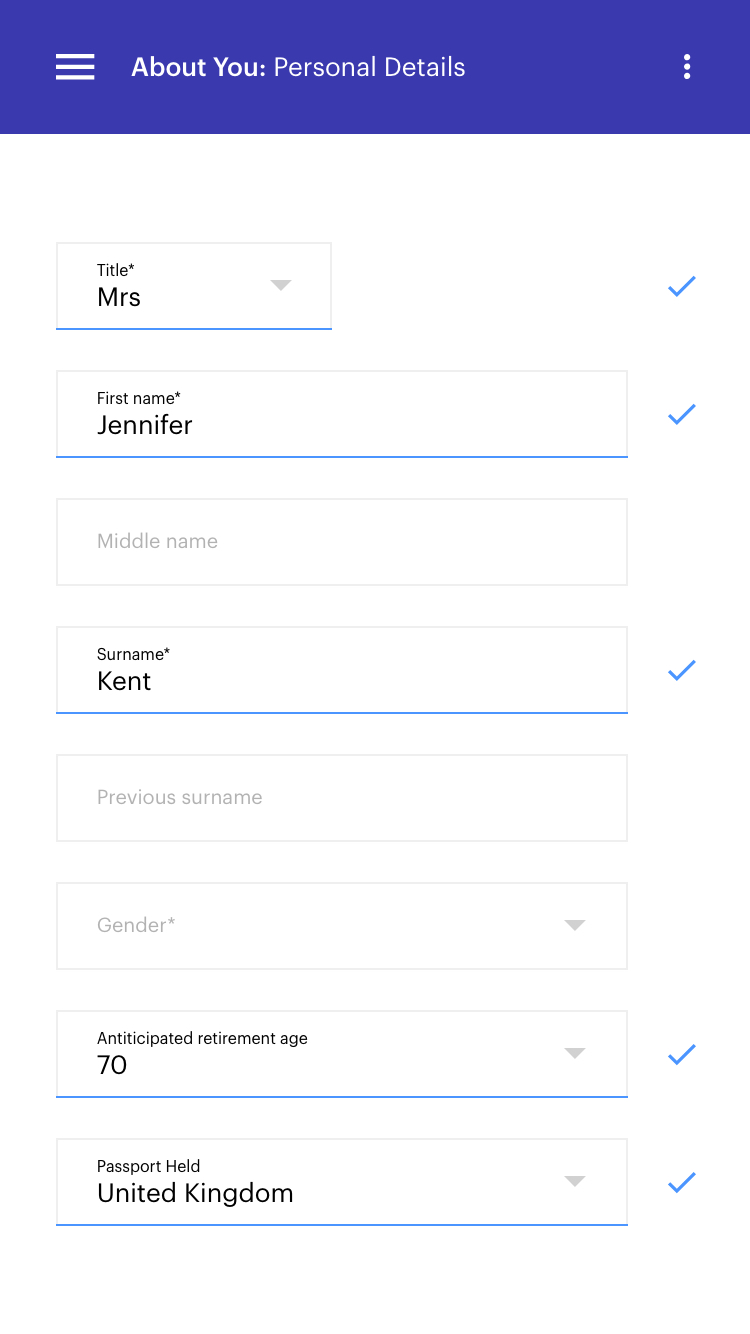

Flexible UI framework

By creating a standardised visual language that could be rolled out across the platform we were able to make the system uniform and easy to use without training.

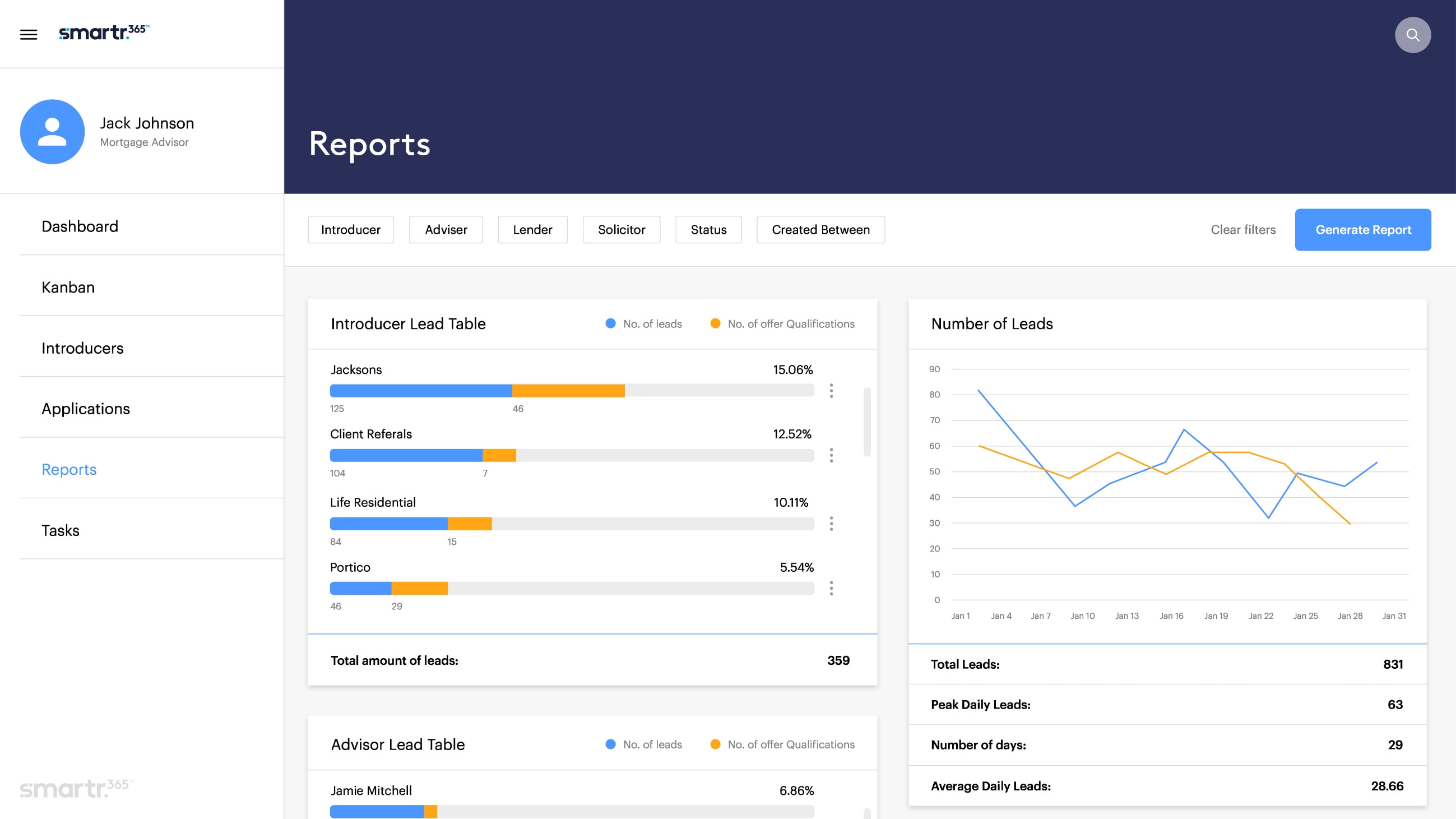

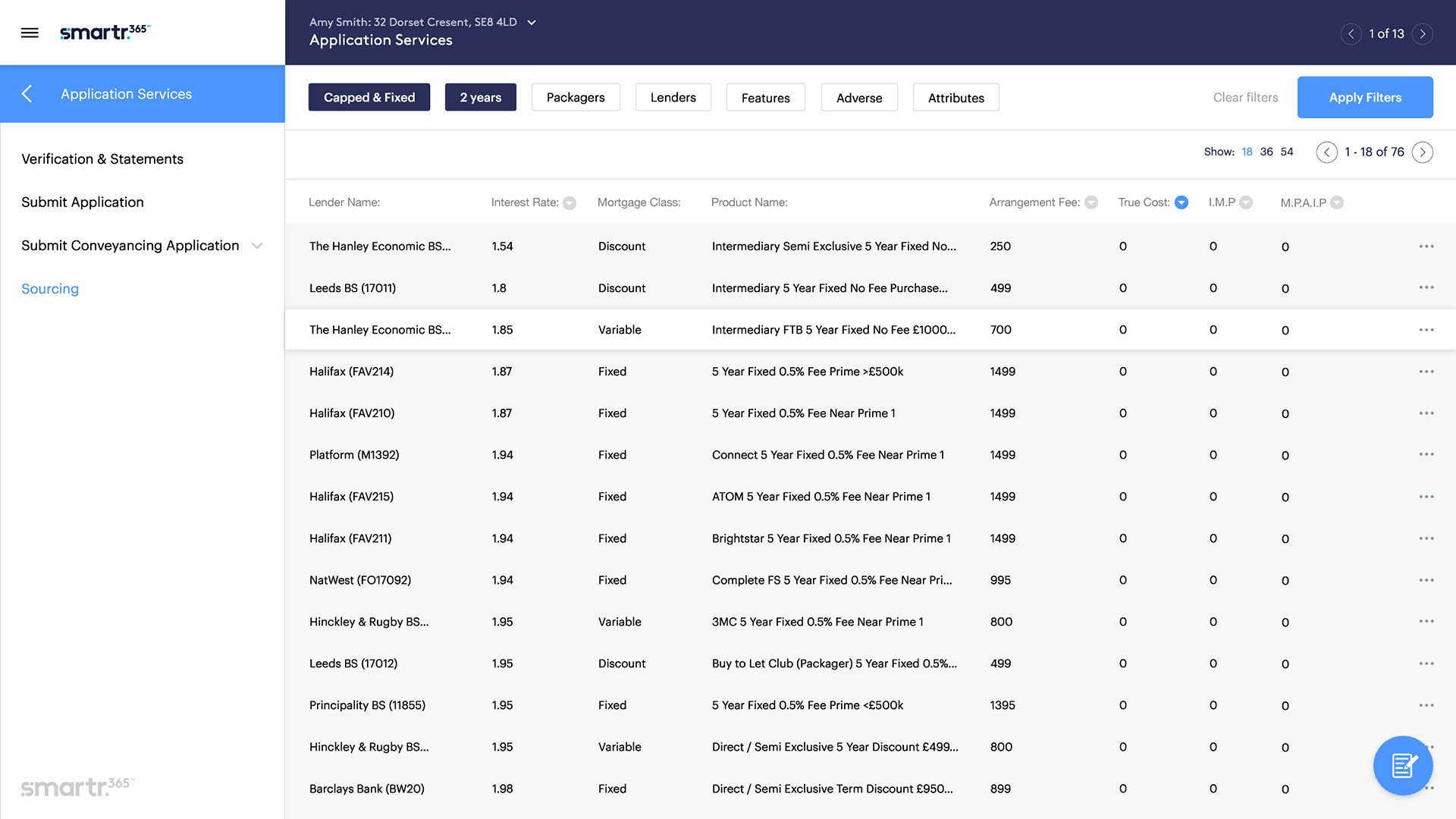

Intelligent reporting

The complex financial reporting models within the system needed to be displayed in a consistent and elegant manner for mortgage advisory firms.

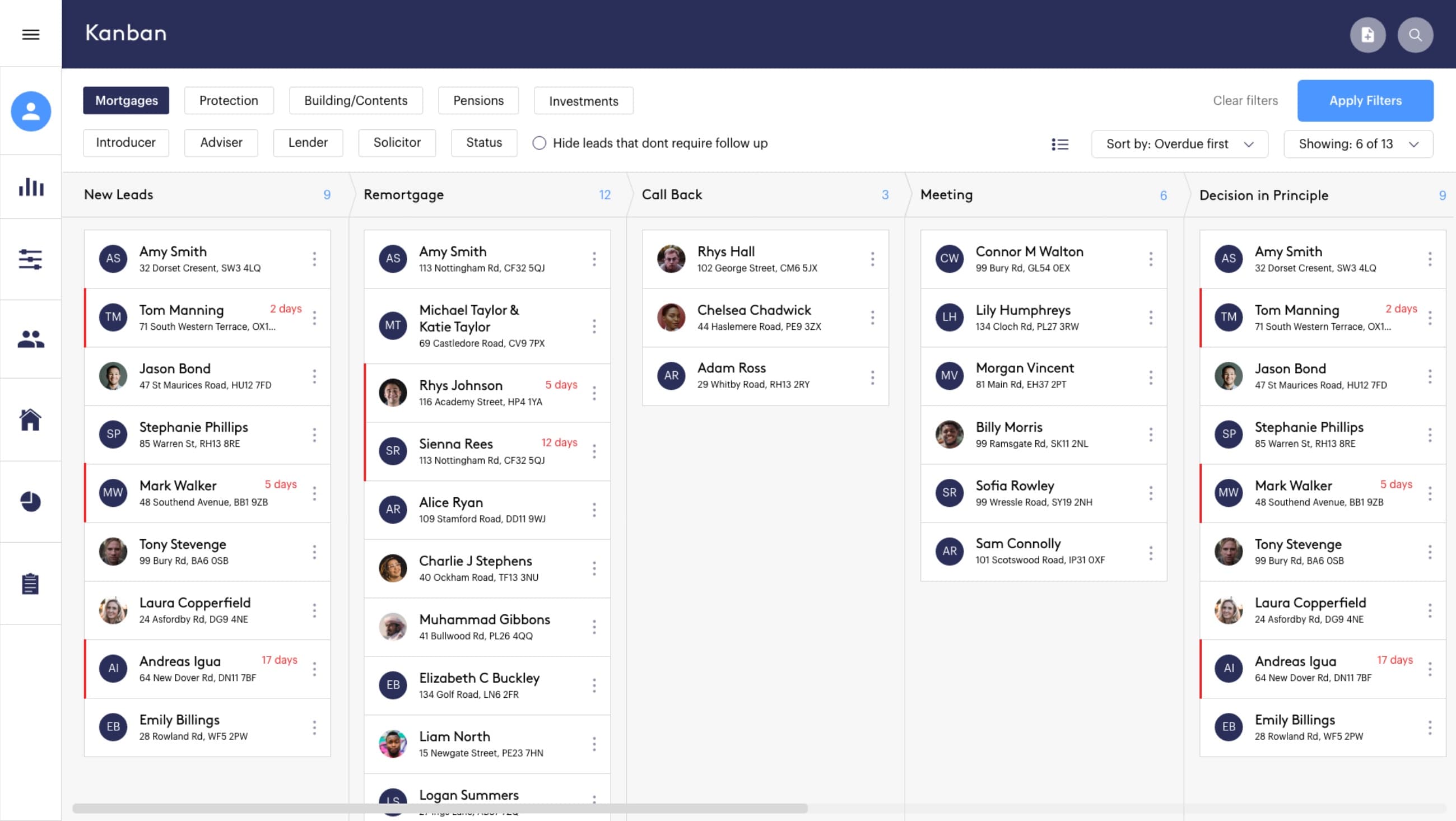

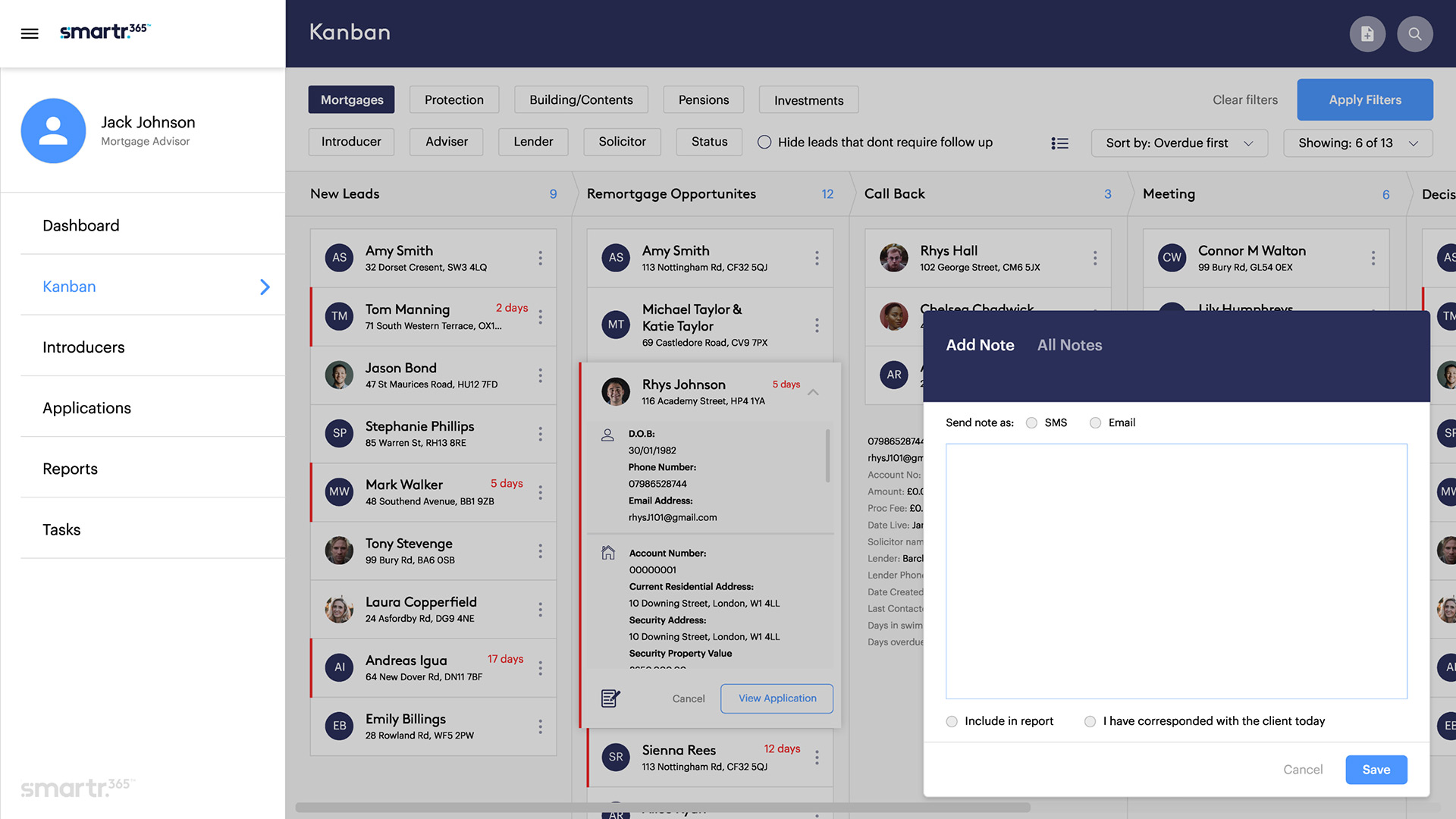

Kanban pipeline

To help drive sales we designed a custom kanban pipeline system with dynamic pop-open cards where you can edit records without leaving the page.

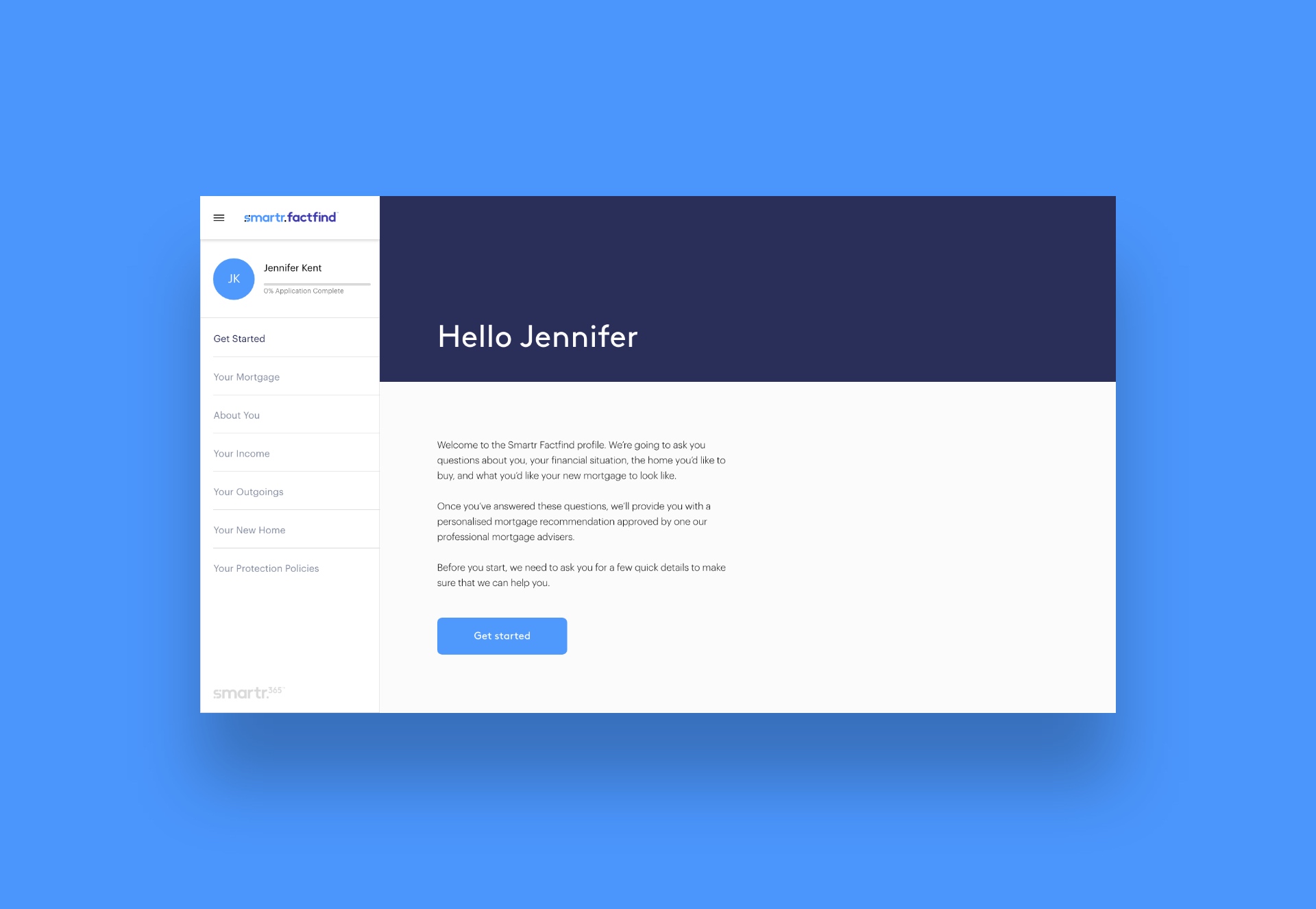

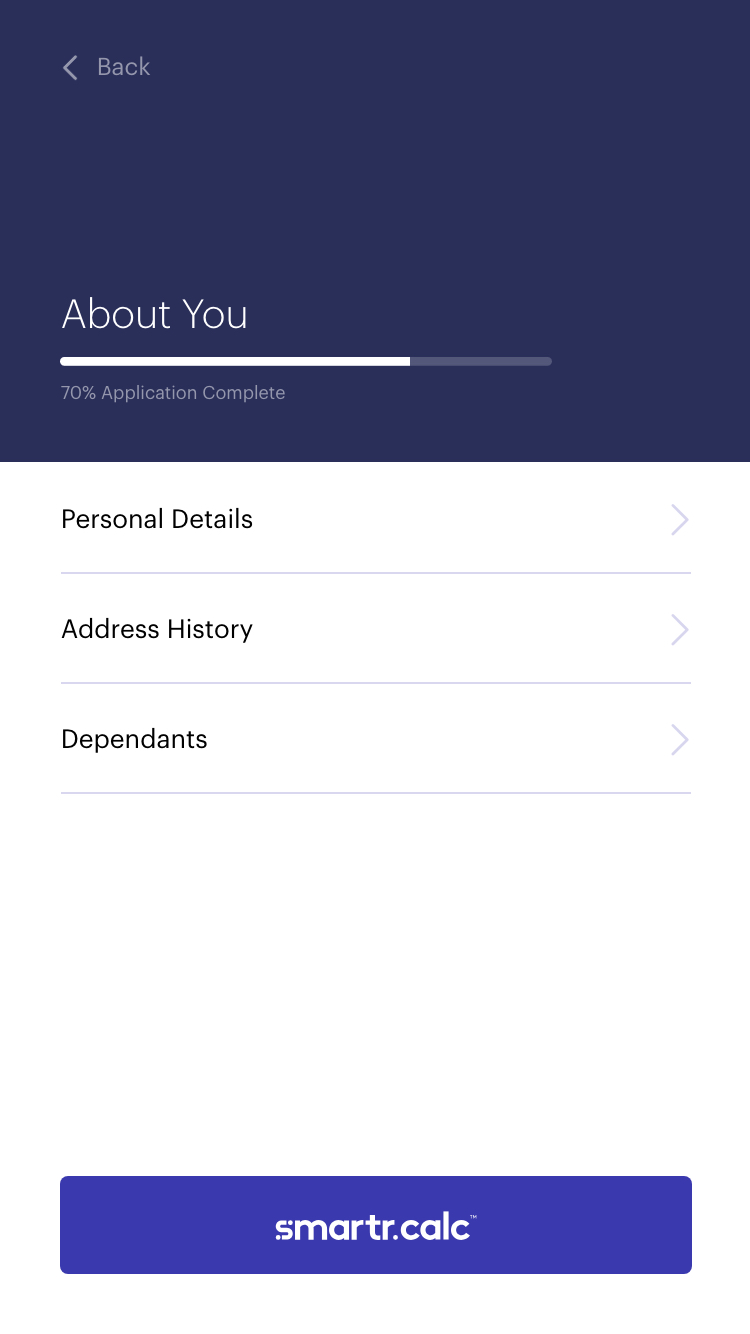

Compliant work flow

The business and legal requirements around work flow demanded a high level of validation, ensuring compliance for the mortgage advisor.

“Plug & Play really got to grips with our complex financial products, processes and users – highly recommended”

The challenge

As with any digital product, the opinion of the end customer is hugely dependent on the design of the User Interface. Our role was to re-invent the user journeys and UX of the platform, to make it faster and easier to use for both end customers looking for mortgages and mortgage advisors. Most importantly of all, mortgage advisors need to want to use it – so it had to look and work brilliantly.

The existing solution

As part of the project, the internal C# / .NET back-end development team needed to re-build large parts of their system; changing the platform’s architecture from MVC to become an API. This meant that to meet the deadline we needed to collaborate closely with the internal team to define the API, as well as running in staggered sprints of implementation to integrate end-points as the back-end team completed them.

A platform people want to use

As a platform with both B2B clients (mortgage advisors) and B2C clients (home buyers), it was important that the platform made it easy to gather the applicant’s details and financial history while remaining highly secure and legally compliant.